Eight Things to Do Now to Cash In at Tax Time

Now is a good time to review your financial situation and do a rough estimate of your income tax bill for the year. This will give you an incentive to consider these short and long-term strategies to minimize your tax bill. Take these steps before year-end to reduce your taxes on your tax return.

The One Big Beautiful Bill that passed includes permanently extending tax cuts from the Tax Cuts and Jobs Act, including increasing the cap on the amount of state and local or sales tax and property tax (SALT) that you can deduct, makes cuts to energy credits passed under the Inflation Reduction Act, makes changes to taxes on tips and overtime for certain workers, reforms Medicaid, increases the Debt ceiling, and reforms Pell Grants and student loans. Updates to this article are in process. Check our One Big Beautiful Bill article for more information.

Key Takeaways

- You can open an IRA account at any time and deduct qualifying contributions of up to $7,000, or $8,000 if you are age 50 or older (tax year 2025) made until the filing deadline.

- If you make qualified energy-saving home improvements by the end of the year, you can claim a tax credit of up to 30% of the costs for tax years 2022 through 2025.

- If you expect to be in a lower tax bracket next year, consider deferring taxes by shifting receipt of the income, such as bonuses, into the following year.

- If you have a high-deductible health plan and aren’t covered by any other health insurance or enrolled in Medicare, you may be able to deduct contributions to a health savings account (HSA).

1. Contribute to an IRA

Socking money away in an IRA doesn’t just help you at retirement—it can also reduce your tax bill today. The maximum tax-deductible contribution to an Individual Retirement Account (IRA) for 2025 is $7,000 and increases to $8,000 if you are age 50 or older. The maximum employee contribution to a 401(k) plan in 2025 is $23,500 and increases to $31,000 if you are age 50 to 59 or 64 or older, and those 60 to 63 can contribute up to $34,750.

You can open an IRA account at any time and still deduct qualifying contributions made until the April filing deadline but making them before year-end starts the clock on tax-deferred growth sooner. The ability to make a tax-deductible contribution to an IRA typically phases out as your income increases.

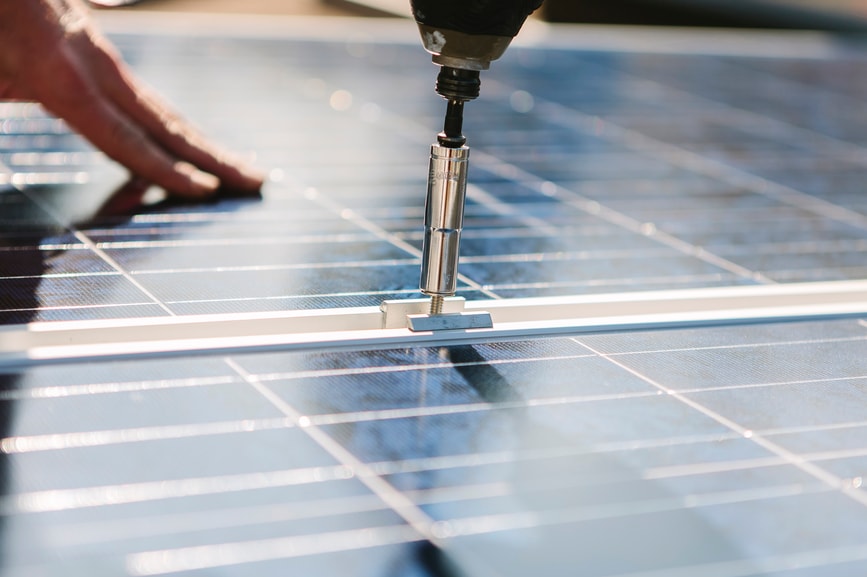

2. Make your house energy-efficient

If you make qualified energy-saving home improvements by the end of the year, you can claim a tax credit of up to 30% of the costs for tax year 2022 through 2025. The improvements have to meet federal energy-efficiency standards to qualify for the credit. For more information, go to www.EnergyStar.gov.

3. Review investment gains and losses

Consider selling investment losers to offset capital gains. When calculating your gains and losses, be sure to include mutual fund distributions; typically, they include taxable gains even when you hold onto the shares.

You may want to sell appreciated securities before year-end (or donate them to charity; see #7 below). If you have losses beyond your gains, up $3,000 can be used to offset other income and the rest can be carried forward into future tax years.

4. Shift income from one year to the next

If you expect to be in a lower tax bracket next year, and have control over the timing of some income, consider deferring taxes by shifting receipt of the income into the following year.

Possibilities include year-end bonuses, capital gains, and self-employment income. Review your situation carefully because your tax rates could be higher in the next year.

TurboTax Tip:

If you expect to be in a lower tax bracket next year, and have control over the timing of some income, consider deferring taxes by shifting receipt of the income into the following year.

5. Bunch elective medical expenses into one year

Because unreimbursed medical expenses are deductible on federal tax returns only to the extent that they exceed 7.5% of your adjusted gross income (AGI), you stand a better chance of having enough to deduct if you group those expenses into a single year.

In adding up your expenses, consider:

- elective dental work

- eyeglasses and contact lenses

- health insurance premiums

- long-term-care insurance premiums

- weight-loss and stop-smoking programs

- certain over-the-counter medical supplies such as hearing aid batteries

6. Make charitable contributions

You can make year-end gifts to charity with cash, goods or even with appreciated securities. If you donate appreciated securities (like stocks), you can take a deduction for the current fair market value.

If you decide to make gifts in cash, you can simply write a check. Or you can put the amount on a credit card in December, pay the bill when it arrives the following year and deduct the donation in current year. Either way, you need to have a letter of acknowledgment from the charity, showing:

- the date of the gift

- the amount

- whether you received any tangible benefit in exchange, such as a thank you gift

Donations of used cars may be deducted at fair market value only if the charity uses the vehicle in its tax-exempt work. If the charity sells it, your contribution is limited to the actual proceeds of the sale by the charity.

7. Fund college expenses for your child or grandchild

Contribute to a 529 college savings plan for your child or grandchild and you may reap some state income tax benefits. You’ll also have tax-free withdrawals from the plan to pay for future college costs. Additionally, direct payments to an institution for educational or medical purposes aren't subject to gift tax limitations.

8. Establish a health savings account

Taxpayers with high-deductible health plans who aren't covered by any other health insurance or enrolled in Medicare may deduct qualified contributions to a health savings account (HSA).

HSA distributions aren't taxable if you use them to pay for qualified medical expenses including:

- deductibles and co-payments

- over-the-counter drugs

- long-term care insurance

- health insurance premiums

- medical expenses during a time of unemployment

An HSA provides triple tax savings:

- contributions are tax-deductible

- earnings on the account are tax-free

- withdrawals for qualified medical expenses are also tax-free

The account goes with you if you change jobs or move, and unused money in the account may be used in future years.

Following these suggestions can reduce your tax bill for the current year and into the future. But keep in mind that if you are subject to the Alternative Minimum Tax (AMT) you may lose some deductions, so you’ll need to follow very different strategies.

And don’t forget state income taxes in your planning; the rules there may differ from federal tax rules.

With TurboTax Expert Full Service, a local expert matched to your unique situation will do your taxes for you start to finish. Or, get unlimited help and advice from tax experts while you do your taxes with TurboTax Expert Assist.

And you can file your own taxes with TurboTax Do It Yourself. Easily start your taxes by adding your forms and answering a few simple questions, then we’ll guide you from there. No matter which way you file, we guarantee 100% accuracy and your maximum refund.

Get started now by logging into TurboTax and file with confidence.