Assisted | Premium

Get unlimited expert advice and uncover every tax deduction for your investment and self-employed income

Star ratings are from 2024

Why use TurboTax Live Assisted Premium?

Whether you’re an investor, independent contractor, or self-employed, get expert help as you go and a final review of your tax return. Your taxes will be 100% accurate, backed by our Expert Approved Guarantee.

View all Live Assisted Premium features

Investment and self-employment taxes done right, with expert assistance

Jumpstart your taxes with last year’s info.

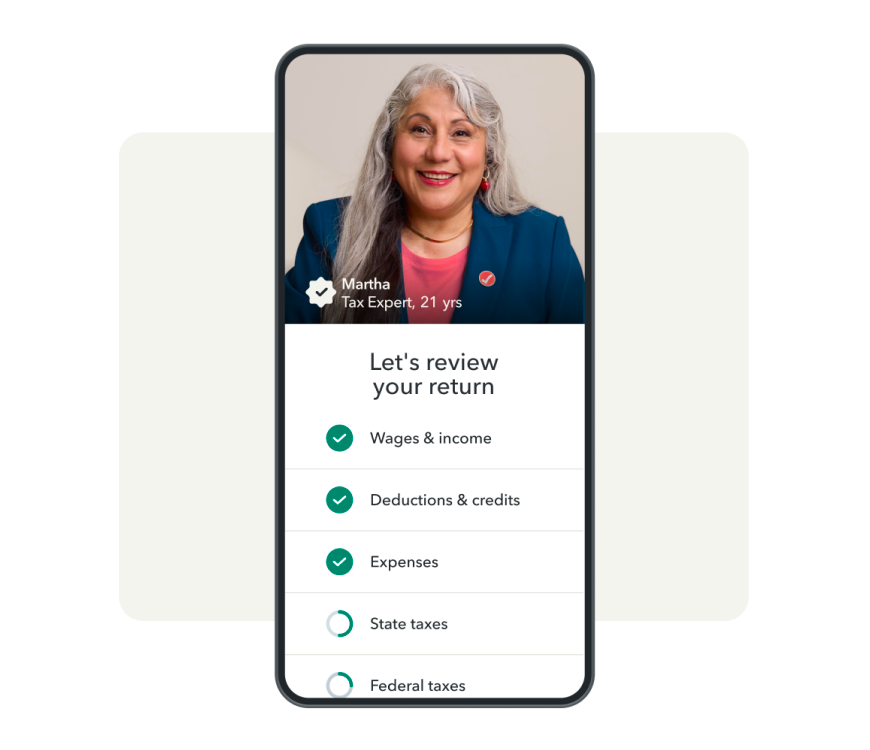

Talk live with tax experts on your schedule while you do your taxes—even on nights and weekends during tax season.

Get AI-powered, personalized answers and guidance from Intuit Assist.

Experts are available to do a final review of your return before filing and make sure it’s done right.

We’re committed to getting you your maximum refund, guaranteed.

- FEATURES

- REVIEWS

- TAX FORMS

- REQUIREMENTS

All Live Assisted Premium features

For investors and rental property owners

Easily import your investment info

We can automatically import investment info from hundreds of participating financial institutions.

Accurate investment tax reporting

We’ll help you report sales of stocks, crypto, bonds, and mutual funds. We’ll calculate capital gains/losses, too.

Bitcoin and other crypto are covered

Sold crypto? We can handle it. We'll calculate your gains or losses and make sure they are reported accurately.

Robust investment reporting

TurboTax Premium is capable of handling over 10,000 stock transactions and 20,000 crypto transactions, so you’re covered no matter how much you trade.

Uncover every credit and deduction

We search for hundreds of credits and deductions like charitable contributions, mortgage interest, property taxes, and the Child Tax Credit.

Great for rental property owners

Calculating and reporting rental depreciation is made simple with TurboTax.

Employee stock plan support

Bought or sold employee stock? Easily determine your correct basis for stocks purchased and more with TurboTax.

Year-round investment support

Get your estimated tax outcome throughout the year, holistic investment portfolio insights, and seamlessly jumpstart tax filing.

For self-employed workers and freelancers

Find industry-specific deductions

Maximize unique deductions across diverse industries: Real Estate, Delivery Driving, Specialty-Trade Construction, Personal Services, Online Retail, Rideshare, Professional Consulting, and many more.

Ideal for 1099-NEC income

Whether you’re getting started or been self-employed for a while, we’re uniquely designed for independent contractors, gig-workers, and freelancers.

Snap & auto-fill your 1099-NEC or 1099-K

Easily and conveniently upload your 1099-NEC or 1099-K with just a snap from your smartphone.

Create employer forms in minutes

Easily create and E-File W-2s and 1099s for your employees and contractors using Quick Employer Forms.

Mileage and vehicle deductions

We'll figure out if you get a bigger deduction by claiming actual expenses or by using the standard mileage rate.

Deduct new business expenses

We’ll show you the startup tax deductions for new businesses so you can get the maximum refund you deserve.

Home office expense help

Have a home office? We'll help you determine what you can deduct and do all the calculations for you, along with tips on how to best manage your home office deductions.

Schedule C import (prior year PDF import)

Save even more time by easily importing a PDF of last year’s tax return from another major tax prep software.

Help and support

Community help

Get unlimited help and advice from tax experts as you do your taxes, and access to the helpful TurboTax community.

Need help from a tax expert?

Choose TurboTax Live Full Service and let a tax expert do taxes for you, start to finish. A local tax expert matched to your unique situation will find every dollar you deserve and get your taxes done right - as soon as today.

Minimum Operating Systems and Browsers

Windows

Windows 10.x

- Firefox 68.x

- Edge 17

- Chrome 74.x

- Opera 64.x

Windows 8.1

- Firefox 68.x

- Edge 17

- Chrome 74.x

- Opera 64.x

Mac

Mac OS 11.0

(Big Sur)

- Safari 14.x

- Chrome 83.x

- Firefox 77.x

- Edge

- Opera 64.x

Mac OS X 10.15.x

(Catalina)

- Safari 13.x

- Chrome 77.x

- Firefox 70.x

- Edge

- Opera 64.x

Mac OS X 10.14.x

(Mojave)

- Safari 13.x

- Chrome 74.x

- Firefox 68.x

- Edge

- Opera 64.x

Mobile / Other

iOS 12.x

- Safari

- Chrome

- Firefox

Android 7.x

- Chromium

default browser

Chromebook

- Chrome

Your tax refund, your way

Get your refund as a check, direct deposit, or up to 5 days early* on a Credit Karma MoneyTM checking or savings account. *Terms apply

File your small business taxes online with expert help

Put your small business in good hands. Let our credentialed small business tax experts help or even do your taxes for you.

Frequently asked questions

You don't need anything but your email address to get started with TurboTax. Just answer a few simple questions and you're on your way.

You don't even need to have your W–2s or 1099s—we can import that information directly from more than a million participating employers and financial institutions.

Learn more about importing into TurboTax.

For more complex tax situations you may need additional documents, like mortgage statements or other detailed financial information. But since we save your return as you go, you can finish anytime.

With TurboTax Live Assisted, you can file confidently with experts by your side.

No matter how complex your tax situation, you can get advice from tax experts who can help you finish your taxes error-free, review your return at the end, and guarantee you’ll get every dollar you deserve.

Yes. We offer free one-on-one audit guidance year-round from our experienced and knowledgeable tax staff. We'll let you know what to expect and how to prepare in the unlikely event you receive an audit letter from the IRS.

If you've already received a letter from the IRS for a return you filed with TurboTax, please review our Audit Support Guarantee for instructions on how to receive FREE step–by–step audit guidance and the option to connect with an expert.

We also offer full audit representation for an additional fee with MAX Defend & Restore.

The best way to file is up to you. TurboTax Live Assisted Premium is a great solution if you feel comfortable doing your own taxes with unlimited expert help as you go. If you want to have a dedicated expert do your self-employment and investment taxes for you, choose TurboTax Live Full Service.

If you trade stocks, you should file with TurboTax Live Assisted Premium. With TurboTax Live Assisted Premium, you can report sales from stocks, crypto, and bonds.

Investors are not required to use a CPA and can use online tax software like TurboTax Live Assisted Premium to report investments. You can also have a dedicated expert do your investment taxes for you with TurboTax Live Full Service.

No, because TurboTax Live Assisted Self-Employed and TurboTax Live Assisted Premier are no longer available. However, TurboTax Live Assisted Premium has all the same features and benefits and covers everything you need to file your self-employment and investment taxes.

If you are a creator, influencer, rideshare driver, work a side gig or other self-employed business and you accept credit, debit, or prepaid cards you may receive Form 1099-K, reporting self-employment payments processed by the third party if you have aggregate payments exceeding $20,000 and more than 200 transactions.

If you are an online seller selling on platforms like eBay, Airbnb, Etsy, and VRBO with sales at the aggregate of more than $20,000 and more than 200 transactions you could also receive a form 1099-K even if you do occasional sales and consider it a hobby.

One thing to remember is if you are self-employed, you are always supposed to claim your self-employed income regardless of the amount and if your net income is $400 or more you are supposed to file a tax return reporting your self-employment income, since you need to pay self-employment taxes. Don’t worry about paying taxes on the entire amount reported on Form 1099-K. You can claim your expenses directly related to your business, lowering your income reported on Form 1099-K.

Learn more

Get your taxes done right and your biggest tax refund—guaranteed

Your tax return, backed for lifeTM

100% accurate calculations, audit support, and your max refund. All backed for the full 7-year life of your tax return.

Your best tax outcome

Whether you file yourself or get expert help, you’ll get your maximum refund guaranteed, or your money back.

Taxes done right

TurboTax calculations are 100% accurate so your taxes will be done right, guaranteed, or we'll pay you any IRS penalties.

Ready to try Live Assisted Premium?

Star ratings are from 2024

TurboTax Online: Important Details about Filing Simple Form 1040 Returns

If you have a simple Form 1040 return only (no forms or schedules except as needed to claim the Earned Income Tax Credit, Child Tax Credit or student loan interest), you can file for free yourself with TurboTax Free Edition, or you can file with TurboTax Live Assisted Basic at the listed price. Roughly 37% of taxpayers are eligible.

Examples of situations included in a simple Form 1040 return (assuming no added tax complexity):

- W-2 income

- Interest, dividends or original issue discounts (1099-INT/1099-DIV/1099-OID) that don’t require filing a Schedule B

- IRS standard deduction

- Earned Income Tax Credit (EITC)

- Child Tax Credit (CTC)

- Student loan interest deduction

- Taxable qualified retirement plan distributions

Examples of situations not included in a simple Form 1040 return:

- Itemized deductions claimed on Schedule A, like charitable contributions, medical expenses, mortgage interest and state and local tax deductions

- Unemployment income reported on a 1099-G

- Business or 1099-NEC income (often reported by those who are self-employed, gig workers or freelancers)

- Stock sales (including crypto investments)

- Income from rental property or property sales

- Credits, deductions and income reported on other forms or schedules

* More important offer details and disclosures

TURBOTAX ONLINE GUARANTEES

- 100% Accurate Calculations Guarantee: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. You are responsible for paying any additional tax liability you may owe. Excludes payment plans. This guarantee is good for the lifetime of your individual or business tax return, which Intuit defines as seven years from the date you filed it with TurboTax. Additional terms and limitations apply. See Terms of Service for details.

- Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state purchase price paid. (TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax, or until December 15, 2025 for your 2024 business tax return. Additional terms and limitations apply. See Terms of Service for details.

- TurboTax Live Full Service Guarantee: If you use TurboTax Live Full Service to file your individual or business tax return, your tax expert will find every dollar you deserve. Your expert will only sign and file your return if they believe it's 100% correct and you are getting your best outcome possible. If you get a larger refund or smaller tax due from another tax preparer by filing an amended return, we'll refund the applicable TurboTax Live Full Service federal and/or state purchase price paid. If you pay an IRS or state penalty (or interest) because of an error that a TurboTax expert made while acting as a signed preparer for your return, we'll pay you the penalty and interest. Additional terms and limitations apply. See Terms of Service for details.

- 100% Accurate Expert-Approved Guarantee: If you pay an IRS or state penalty (or interest) because of an error that a TurboTax expert made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your individual or business tax return, we'll pay you the penalty and interest. You are responsible for paying any additional tax liability you may owe. Limitations apply. See Terms of Service for details.

- Business Tax Guarantee: If you use TurboTax to file your business tax return, you will be covered by a combination of our 100% accurate calculations, maximum savings and audit support guarantees. If you pay an IRS or state penalty (or interest) because of a TurboTax calculation error or an error that a TurboTax expert made while acting as a signed preparer for your return, we'll pay you the penalty and interest. You are responsible for paying any additional tax liability you may owe. If you get a larger refund or smaller tax due from another tax preparer by filing an amended return, we'll refund the applicable TurboTax Live Business federal and/or state purchase price paid. If you receive an audit letter from the IRS or State Department of Revenue, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center. For representation before the IRS, our fee-based Audit Defense add-on service is available for purchase (sold separately). Additional terms and limitations apply. See Terms of Service for details.

- Audit Support Guarantee: If you receive an audit letter from the IRS or State Department of Revenue based on your 2024 TurboTax individual or business tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center, for audited individual or business returns filed with TurboTax for the current 2024 tax year, and solely for individual, non-business returns for the past two tax years (2023, 2022). Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. For IRS representation, our fee-based Audit Defense service is available for purchase (sold separately). If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state purchase price paid. (TurboTax Free Edition customers are entitled to payment of $30.) This guarantee is good for the lifetime of your individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax, or for three years from the date you filed your business tax return. Additional terms and limitations apply. See Terms of Service for details.

- Satisfaction Guaranteed: You may use TurboTax Online without charge up to the point you decide to print or electronically file your individual or business tax return. Printing or electronically filing your return reflects your satisfaction with TurboTax Online, at which time you will be required to pay or register for the product. Additional terms and limitations apply. See Terms of Service for details.

- 5 Days Early Refund Fee Guarantee: If you choose to receive your federal tax refund through the TurboTax 5 Days Early service and your refund is deposited into your selected bank account less than 5 days before the IRS refund settlement date (the date it would have arrived if sent from the IRS directly), then you will not be charged the 5 Days Early fee. Excludes TurboTax Business products and services. Limitations apply. See Terms of Service for more details.

TURBOTAX ONLINE/MOBILE OFFERS & PRICING

The following TurboTax Online offers may be available for tax year 2024. Intuit reserves the right to modify or terminate any offer at any time for any reason in its sole discretion. Unless otherwise stated, each offer is not available in combination with any other TurboTax offers. Certain discount offers may not be valid for mobile in-app purchases and may be available only for a limited period of time.

- Start for Free/Pay When You File: TurboTax online and mobile pricing is based on your tax situation and varies by product. For most paid TurboTax online and mobile offerings, you may start using the tax preparation features without paying upfront, and pay only when you are ready to e-file, print, file by mail, or purchase add-on products or services. Actual prices for paid versions are determined based on the version you use and the date and/or time you print or e-file, and are subject to change without notice. Unless otherwise specified, strikethrough prices reflect anticipated final, undiscounted prices for tax year 2024.

- TurboTax Free Edition: TurboTax Free Edition ($0 Federal + $0 State + $0 To File) is available for those filing simple Form 1040 returns only (no forms or schedules except as needed to claim the Earned Income Tax Credit, Child Tax Credit and student loan interest). More details are available here. Roughly 37% of taxpayers qualify. Offer may change or end at any time without notice.

- TurboTax Free Mobile App Offer: File for free when you start and finish your own taxes in the TurboTax mobile app by February 18, 2024, 11:59pm ET. You are not eligible for this offer if you used TurboTax to file your 2023 taxes. Offer applies only to individual taxes filed with TurboTax do-it-yourself products and excludes TurboTax Live products.

- TurboTax Full Service - Forms-Based Pricing: “Starting at” pricing represents the base price for one federal return (includes one W-2 and one Form 1040). Final price may vary based on your actual tax situation and forms used or included with your return. Price estimates are provided prior to a tax expert starting work on your taxes. Estimates are based on initial information you provide about your tax situation, including forms you upload to assist your expert in preparing your tax return and forms or schedules we think you'll need to file based on what you tell us about your tax situation. Final price is determined at the time of print or electronic filing and may vary based on your actual tax situation, forms used to prepare your return, and forms or schedules included in your individual return. Prices are subject to change without notice and may impact your final price. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate after you discuss your tax situation with them.

TURBOTAX ONLINE/MOBILE

- Anytime, anywhere: Internet access required; standard data rates apply to download and use mobile app.

- Fastest refund possible: Get your tax refund from the IRS as fast as possible by e-filing and choosing to receive your refund by direct deposit. Tax refund time frames will vary. Last tax year, the IRS issued more than 9 out of 10 refunds in less than 21 days.

- Get your tax refund 5 days early in your bank account: If you choose this paid add-on feature, your federal tax refund will be deposited to your selected bank account 5 days before the refund settlement date provided by the IRS (the date your refund would have arrived if sent from the IRS directly). The receipt of your refund 5 Days Early is subject to IRS submitting refund information to us at least 5 days before the refund settlement date. IRS does not always provide refund settlement information 5 days early. You will not be eligible to receive your refund 5 Days Early if (1) you take a Refund Advance loan, (2) IRS delays payment of your refund, or (3) your bank's policies do not allow for same-day payment processing. 5 Days Early fee will be deducted directly from your refund prior to being deposited to your bank account. If your refund cannot be delivered 5 Days Early, you will not be charged the 5 Days Early fee. Excludes business tax returns. 5 Days Early program may change or be discontinued at any time without notice.

Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services. For more information about Intuit Payments' money transmission licenses, please visit https://www.intuit.com/legal/licenses/payment-licenses/. - Get your tax refund up to 5 days early with Credit Karma Money™: When it's time to file, have your tax refund direct deposited to a Credit Karma Money™ checking or savings account, and you could receive your funds up to 5 days early. If you choose to pay your tax preparation fee with TurboTax using your federal tax refund or if you choose to take the Refund Advance loan, you will not be eligible to receive your refund up to 5 days early with Credit Karma. 5-day early program may change or discontinue at any time. Up to 5 days early access to your federal tax refund is compared to standard tax refund electronic deposit and is dependent on and subject to IRS submitting refund information to the bank before release date. IRS may not submit refund information early. Excludes business tax returns. Banking services for Credit Karma Money accounts are provided by MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply per account. For more information, please visit https://turbotax.intuit.com/credit-karma-money/.

- Loan details and disclosures for the Refund Advance program: If you expect to receive a federal refund of $500 or more, you could be eligible for a Refund Advance loan. Refund Advance loans may be issued by First Century Bank, N.A. or WebBank, neither of which are affiliated with MVB Bank, Inc., Member FDIC. Refund Advance is a loan based upon your anticipated refund and is not the refund itself. 0% APR and $0 loan fees. Availability of the Refund Advance is subject to satisfaction of identity verification, certain security requirements, eligibility criteria, and underwriting standards. This Refund Advance offer expires on February 28, 2025, or the date that available funds have been exhausted, whichever comes first. Offer, eligibility, and availability subject to change without further notice.

Refund Advance loans issued by First Century Bank, N.A. are facilitated by Intuit TT Offerings Inc. (NMLS # 1889291), a subsidiary of Intuit Inc. Refund Advance loans issued by WebBank are facilitated by Intuit Financing Inc. (NMLS # 1136148), a subsidiary of Intuit Inc. Although there are no loan fees associated with the Refund Advance loan, separate fees may apply if you choose to pay for TurboTax with your federal refund. Paying with your federal refund is not required for the Refund Advance loan. Additional fees may apply for other products and services that you choose.

You will not be eligible for the loan if: (1) your physical address is not included on your federal tax return, (2) your physical address is located outside of the United States or a US territory, is a PO box or is a prison address, (3) your physical address is in one of the following states: IL, CT, or NC, (4) you are less than 18 years old, (5) the tax return filed is on behalf of a deceased person, (6) you are filing certain IRS Forms (1310, 4852, 4684, 4868, 1040SS, 1040PR, 1040X, 8888, or 8862), (7) your expected refund amount is less than $500, or (8) you did not receive Forms W-2 or 1099-R or you are not reporting income on Sched C. Additional requirements: You must (a) e-file your federal tax return with TurboTax and (b) currently have or open a Credit Karma Money™ Spend (checking) account with MVB Bank, Inc., Member FDIC. Maximum balance and transfer limits apply. Opening a Credit Karma Money™ Spend (checking) account is subject to eligibility. Please see Credit Karma Money Spend Account Terms and Disclosures for details.

Not all consumers will qualify for a loan or for the maximum loan amount. If approved, your loan will be for one of ten amounts: $250, $500, $750, $1,000, $1,500, $2,000, $2,500, $3,000, $3,500, or $4,000. Your loan amount will be based on your anticipated federal refund to a maximum of 50% of that refund amount. You will not receive a final decision of whether you are approved for the loan until after the IRS accepts your e-filed federal tax return. Loan repayment is deducted from your federal tax refund and reduces the subsequent refund amount paid directly to you.

If approved, your Refund Advance will be deposited into your Credit Karma Money™ Spend (checking) account typically within 15 minutes after the IRS accepts your e-filed federal tax return and you may access your funds online through a virtual card. Your physical Credit Karma Visa® Debit Card* should arrive in 7 - 14 days. *Card issued by MVB Bank, Inc., Member FDIC pursuant to a license from Visa U.S.A. Inc.; Visa terms and conditions apply. Other fees may apply. For more information, please visit: https://support.creditkarma.com/s/article/Are-there-fees-with-a-Credit-Karma-Money-Spend-account.

If you are approved for a loan, your tax refund after deducting the amount of your loan and agreed-upon fees (if applicable) will be placed in your Credit Karma Money™ Spend (checking) account. Tax refund funds are disbursed by the IRS typically within 21 days of e-file acceptance. If you apply for a loan and are not approved after the IRS accepts your e-filed federal tax return, your tax refund minus any agreed-upon fees (if applicable) will be placed in your Credit Karma Money™ Spend (checking) account.

If your tax refund amounts are insufficient to pay what you owe on your loan, you will not be required to repay any remaining balance. However, you may be contacted to remind you of the remaining balance and provide payment instructions to you if you choose to repay that balance. If your loan is not paid in full, you will not be eligible to receive a Refund Advance loan in the future. - Pay for TurboTax out of your federal refund or state refund: Individual taxes only. Subject to eligibility requirements. Additional terms apply. A $40 service fee may apply to this payment method. Prices are subject to change without notice.

- TurboTax Help and Support: Access to a TurboTax product specialist is included with TurboTax Deluxe, Premium, TurboTax Live Assisted and TurboTax Live Full Service; not included with Free Edition (but is available as a paid upgrade). TurboTax specialists are available to provide general customer help and support using the TurboTax product. Services, areas of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice. Limitations apply. See Terms of Service for details.

- TurboTax Live - Tax Advice and Expert Review: Access to an expert for tax questions and Expert Review (the ability to have a tax expert review) is included with TurboTax Live Assisted or as an upgrade from another TurboTax product, and available through December 31, 2025. Access to an expert for tax questions is also included with TurboTax Live Full Service and available through December 31, 2025. If you use TurboTax Live, Intuit will assign you a tax expert based on availability. Tax expert availability may be limited. Some tax topics or situations may not be included as part of this service, which shall be determined at the tax expert's sole discretion. The ability to retain the same expert preparer in subsequent years will be based on an expert’s choice to continue employment with Intuit and their availability at the times you decide to prepare your return(s). Administrative services may be provided by assistants to the tax expert. On-screen help is available on a desktop, laptop or the TurboTax mobile app. For the TurboTax Live Assisted product: If your return requires a significant level of tax advice or actual preparation, the tax expert may be required to sign as the preparer at which point they will assume primary responsibility for the preparation of your return. For the TurboTax Live Full Service product: Hand off tax preparation by uploading your tax documents, getting matched with an expert, and meeting with an expert in real time. The tax expert will sign your return as a preparer.

- TurboTax Live - Unlimited Expert Support: Unlimited access to TurboTax Live experts refers to an unlimited quantity of contacts available to each customer, but does not refer to hours of operation or service coverage. Service, area of expertise, experience levels, wait times, hours of operation and availability vary, and are subject to restriction and change without notice.

- TurboTax Experts - Years of Experience: Based on experts' self-reported years of tax experience.

- TurboTax Live - Expert Availability: TurboTax Live experts are available on nights and weekends for certain expanded hours during tax season (from January to April) and in the weeks leading up to tax extension deadlines. Outside of tax season, regular hours are Monday through Friday 5am to 5pm PT. Service, area of expertise, experience levels, and wait times vary, and are subject to restriction and change without notice. Unlimited access to TurboTax Live experts is included with all TurboTax Live products.

- TurboTax Live Full Service - File your taxes as soon as today: TurboTax Full Service experts are available to prepare 2024 tax returns starting January 6, 2025. One-day preparation and filing availability depends on start time, the complexity of your return, is based on completion time for the majority of customers, and may vary based on expert availability. A tax preparation assistant will validate the customer's tax situation during the welcome call and review uploaded documents to assess readiness and ability to file same-day. All tax forms and documents must be ready and uploaded by the customer for the tax preparation assistant to refer the customer to an available expert for live tax preparation.

- TurboTax Live Full Service - “Local”: For purposes of virtual meetings, “Local" experts are defined as being located within the same state as the consumer's zip code. Not available in all states.

- Smart Insights: Individual taxes only. Included with TurboTax Deluxe, Premium, TurboTax Live, TurboTax Live Full Service, or with PLUS benefits, and is available through November 1, 2025. Terms and conditions may vary and are subject to change without notice.

- My Docs: Included with TurboTax Deluxe, Premium TurboTax Live, TurboTax Live Full Service, or with PLUS benefits and is available through December 31, 2025. Terms and conditions may vary and are subject to change without notice.

- Tax Return Access: Included with all TurboTax Free Edition, Deluxe, Premium, TurboTax Live, and TurboTax Live Full Service products. Access to up to seven years of tax returns we have on file for you is available through December 31, 2025. Terms and conditions may vary and are subject to change without notice.

- Easy Online Amend: Individual taxes only. With TurboTax Deluxe, Premium, TurboTax Live, TurboTax Live Full Service, or with PLUS benefits, you can make changes to your 2024 tax return online through October 31, 2027. For TurboTax Live Full Service, your tax expert will amend your 2024 tax return for you through November 15, 2025; after that date, TurboTax Live Full Service customers will be able to amend their 2024 tax return themselves using the Easy Online Amend process described above. TurboTax Free Edition customers may amend 2024 tax returns online through October 31, 2025. Terms and conditions may vary and are subject to change without notice.

- #1 best-selling tax software: Based on aggregated sales data for all tax year 2023 TurboTax products.

- #1 online tax filing solution for self-employed: Based upon IRS Sole Proprietor data as of calendar year 2024, for tax year 2023. Self-Employed defined as a return with a Schedule C/C-EZ tax form. Online competitor data is extrapolated from press releases and SEC filings. “Online” is defined as an individual income tax DIY return (non-preparer signed) that was prepared online and either e-filed or printed, not including returns prepared through desktop software.

- 1099-Ks: Those filing in TurboTax Free Edition, TurboTax Live Assisted Basic or TurboTax Live Full Service Basic will be able to file a limited IRS Schedule 1 if they have hobby income or personal property rental income reported on a Form 1099-K, and/or a limited IRS Schedule D if they have personal item sales with no gain reported on Form 1099-K. Those filing in TurboTax Deluxe, TurboTax Live Assisted Deluxe or TurboTax Live Full Service Deluxe will be able to file a limited IRS Schedule D if they have personal item sales income reported on Form 1099-K. If you add other schedules or forms, or need to report other types of income on Schedules 1, D, E, F, or Form 4835 you may be required to upgrade to another TurboTax product.

- 1099-K Snap and Autofill: Available in mobile app and mobile web only.

- 1099-NEC Snap and Autofill: Available in TurboTax Premium (formerly Self-Employed) and TurboTax Live Assisted Premium (formerly Self-Employed). Available in mobile app only. Feature available within Schedule C tax form for TurboTax filers with 1099-NEC income.

- Year-Round Tax Estimator: Available in TurboTax Premium (formerly Self-Employed) and TurboTax Live Assisted Premium (formerly Self-Employed). This product feature is only available after you finish and file in a self-employed TurboTax product.

- Refer a Friend: Maximum of $500 in total rewards for 20 referrals. See official terms and conditions for more details.

- Refer your Expert (Intuit's own experts): Maximum of $500 in total rewards for 20 referrals. See official terms and conditions for more details.

- Refer your Expert (TurboTax Verified Pro): Maximum of $500 in total rewards for 20 referrals. See official terms and conditions for more details.

- Average Refund Amount: $3,207 is the average refund amount American taxpayers received in the 2024 filing season based upon IRS data as of February 16, 2024 and may not reflect actual refund amount received. Each taxpayer's refund will vary based on their tax situation.

- More self-employed deductions: based on the median amount of expenses found by TurboTax Premium (formerly Self Employed) customers who synced accounts, imported and categorized transactions compared to manual entry. Individual results may vary.

- TurboTax Online Business Products: For TurboTax Live Assisted Business and TurboTax Full Service Business, we currently don't support the following tax situations: C-Corps (Form 1120) and entities electing to be treated as a C-Corp, Trust/Estates (Form 1041), Tax Exempt Entities/Non-Profits, returns that require more than 5 state filings, and other issues unrelated to the preparation of a tax return or unrelated to business income/franchise taxes. TurboTax Live Assisted Business is currently available only in AK, AZ, CA, CO, CT, DE, FL, GA, ID, IL, KS, MA, MD, ME, MI, MN, MO, NC, NJ, NV, NY, OH, PA, RI, SD, TN, TX, UT, VA, WA, WV, and WY.

- Audit Defense: Audit Defense is a third-party add-on service provided, for an additional fee, by TaxResources, Inc., dba Tax Audit. Audit Defense is included at no added cost with business returns filed with TurboTax Live Business (excluding Sole Proprietor). See Membership Agreements at https://www.intuit.com/legal/terms/ for service terms and conditions.

TURBOTAX DESKTOP GUARANTEES

TurboTax Desktop Individual Returns:

- 100% Accurate Calculations Guarantee - Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. Excludes payment plans. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Maximum Refund Guarantee / Maximum Tax Savings Guarantee - or Your Money Back - Individual Returns: If you get a larger refund or smaller tax due from another tax preparation method by filing an amended return, we'll refund the applicable TurboTax federal and/or state software license purchase price you paid. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Audit Support Guarantee - Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your 2024 TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center, for audited individual returns filed with TurboTax Desktop for the current 2024 tax year and, for individual, non-business returns, for the past two tax years (2022, 2023). Audit support is informational only. We will not represent you before the IRS or state tax authority or provide legal advice. If we are not able to connect you to one of our tax professionals, we will refund the applicable TurboTax federal and/or state license purchase price you paid. This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax Desktop. Excludes TurboTax Desktop Business returns. Additional terms and limitations apply. See License Agreement for details.

- Satisfaction Guarantee/ 60-Day Money Back Guarantee: If you're not completely satisfied with TurboTax Desktop software, go to refundrequest.intuit.com within 60 days of purchase and follow the process listed to submit a refund request. You must return this product using your license code or order number and dated receipt. Desktop add-on products and services purchased are non-refundable.

TurboTax Desktop Business Returns:

- 100% Accurate Calculations Guarantee - Business Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest. Excludes payment plans. You are responsible for paying any additional tax liability you may owe. Additional terms and limitations apply. See License Agreement for details.

- Maximum Tax Savings Guarantee - Business Returns: If you get a smaller tax due (or larger business tax refund) from another tax preparation method using the same data, TurboTax will refund the applicable TurboTax Business Desktop license purchase price you paid. Additional terms and limitations apply. See License Agreement for details.

- Satisfaction Guarantee/ 60-Day Money Back Guarantee: If you're not completely satisfied with TurboTax Desktop software, go to refundrequest.intuit.com within 60 days of purchase and follow the process listed to submit a refund request. You must return this product using your license code or order number and dated receipt. Desktop add-on products and services purchased are non-refundable.

TURBOTAX DESKTOP DISCLAIMERS

- Installation Requirements: Product download, installation and activation requires an Intuit Account and internet connection. Product limited to one account per license code. You must accept the TurboTax License Agreement to use this product. Not for use by paid preparers.

- TurboTax Desktop Products: Price includes tax preparation and printing of federal tax returns and free federal e-file of up to 5 federal tax returns. Additional fees apply for e-filing state returns. E-file fees may not apply in certain states, check here for details. Savings and price comparison based on anticipated price increase. Software updates and optional online features require internet connection. Desktop add-on products and services purchased are non-refundable.

- Fastest Refund Possible: Get your tax refund from the IRS as fast as possible by e-filing and choosing to receive your refund by direct deposit. Tax refund time frames will vary. The IRS issues more than 9 out of 10 refunds in less than 21 days.

- Average Refund Amount: $3,207 is the average refund amount American taxpayers received in the 2024 filing season based upon IRS data as of February 16, 2024 and may not reflect actual refund amount received.

- TurboTax Technical Support: Customer service and technical support hours and options vary by time of year.

- Deduct From Your Federal Refund: Individual taxes only. Subject to eligibility requirements. Additional terms apply. A $40 Refund Processing Service fee applies to this payment. method. Prices are subject to change without notice.

- Data Import: Imports financial data from participating companies; Requires Intuit Account. Quicken and QuickBooks import not available with TurboTax installed on a Mac. Imports from Quicken (2022 and higher) and QuickBooks Desktop (2023 and higher); both Windows only. Quicken import not available for TurboTax Desktop Business. Quicken products provided by Quicken Inc., Quicken import subject to change.

- Live Tax Advice: Access to tax experts to obtain answers to tax questions and to assist with tax year 2024 return(s) prepared with TurboTax Desktop software. Additional fees apply. Must be purchased and used by October 31, 2025. Excludes TurboTax Desktop Business. See License Agreement for details.

- Audit Defense: Audit Defense is a third-party add-on service provided, for a fee, by TaxResources, Inc., dba Tax Audit. See Membership Agreements at https://turbotax.intuit.com/corp/softwarelicense/ for service terms and conditions.

All features, services, support, prices, offers, terms and conditions are subject to change without notice.

Tax & Online Software Products

Deluxe to maximize tax deductions

TurboTax self-employed & investor taxes

Free military tax filing discount

TurboTax Live tax expert products

TurboTax Live Full Service Pricing

TurboTax Live Full Service Business Taxes

TurboTax Live Assisted Business Taxes

Tax tools

En Español

©1997-2024 Intuit, Inc. All rights reserved.

Intuit, QuickBooks, QB, TurboTax, Credit Karma, and Mailchimp are registered trademarks of Intuit Inc. Terms and conditions, features, support, pricing, and service options subject to change without notice.

Security Certification of the TurboTax Online application has been performed by C-Level Security.

By accessing and using this page you agree to the Terms of Use.