TurboTax / Personal Tax Calculator & Tools /

Tax Refund Calculator

Tax Calculator

2023

Estimate your 2023 refund (taxes you file in 2024) with our income tax calculator by

answering simple questions

about your life and income.

Terms of Service

How to estimate your tax refund with Taxcaster

Tell us about yourself

We use general info such as your filling status, number of dependents, and taxable income to get an understanding of your

tax situation.

Let us know if you can claim any tax deductions

Do you own a home, have student loans, give donations, or any other itemized deductions? We use this information in our tax return calculator to give you an accurate estimate of

your return.

See your estimated income tax refund

Based on your info, our tax refund estimator calculates your tax return, or amount owed for this tax year. Use this to get a head start understanding

your taxes.

Frequently asked questions

Enter some simple questions about your situation, and TaxCaster will estimate your tax refund amount, or how much you may owe to the IRS. TaxCaster stays up to date with the latest tax laws, so you can be confident the calculations are current. The results are only estimates however, as various other factors can impact your tax outcome in the income tax calculator. When you file with TurboTax, we’ll guide you step by step to ensure your taxes are done accurately.

Start TurboTax for free

The simplest way to lower the amount you owe is to adjust your tax withholdings on your W-4. Our W-4 Calculator can help you determine how to update your W-4 to get your desired tax outcome.

There are a variety of other ways you can lower your tax liability, such as:

- Taking advantage of deductions

- Making charitable contributions

- Maximizing your business expenses

Your tax bracket is determined by your taxable income and filing status. Knowing your tax bracket can help you make smarter financial decisions. Use our Tax Bracket Calculator to determine your bracket.

The standard deduction is a set amount based on your filing status. Itemized deductions are ones you can claim based on your yearly expenses. It makes sense to choose whichever will yield you the greatest tax break, but if you choose to itemize deductions, you’ll need to keep track of your expenses and have receipts or documentation ready.

Read more about standard and itemized deductions

Estimating your tax refund can help you prepare for tax season. By using a tax refund calculator, you'll get an idea of how much you might get back or owe. This can help you plan your finances better, whether it's setting aside money if you owe taxes or planning how to use a potential refund. Remember, it's just an estimate, but it can give you a good starting point.

See how to track your tax refund here.

After getting a 2023 tax return estimate using the TaxCaster tax estimator for the 2024 tax filing season, it's time to plan. If you're expecting a refund, consider how you can use it wisely. Maybe it's time to boost your emergency fund, pay down debt, or invest in your future. If you owe taxes, start budgeting now to cover that upcoming expense. You can also look at ways to potentially increase your refund, like checking if you've taken advantage of all eligible tax deductions and credits. Remember, the TaxCaster tax estimator gives you an insight into your tax situation.

This TurboTax calculator is one of many tools that you can use to plan ahead for tax season. See all of our tax tools here.

The TaxCaster calculator is designed for estimating federal taxes. Federal and state taxes are different, with federal taxes covering nationwide programs and services, while state taxes fund state-specific needs. However, while the calculator focuses on federal taxes, TurboTax can help you with both federal and state taxes. Our tools are designed to consider the specific tax laws and provisions of each state, helping you accurately prepare both your state and federal taxes.

Learn more about state income taxes.

If you've followed all the recommendations to lower your tax liability and still owe taxes, don't worry. TurboTax offers several ways to pay, including direct debit from a bank account and mail-in payments. If you can't pay the full amount right away, the IRS offers payment plans and installment agreements. Remember, even if you file for an extension, any payment you owe is still due by the April deadline.

Learn more about your options if you’re having trouble paying your taxes.

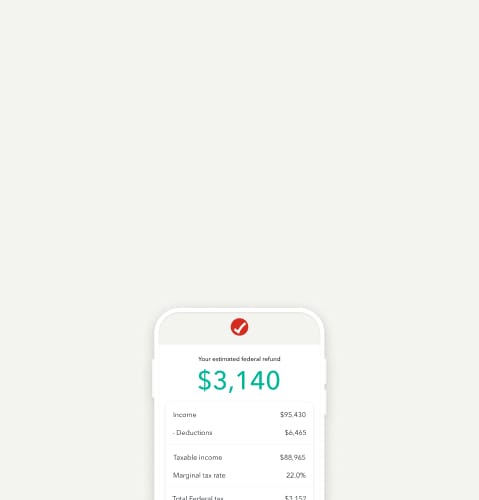

- Your filing status: Whether you're single, married filing jointly, etc.

- Income details: This includes your total income and details of any deductions or credits you're eligible for.

- Information on taxes already paid: If you've had any federal income tax withheld or made estimated tax payments, you'll need these amounts.

Keep in mind, you don’t need to wait to have your final documents in-hand to use the calculator. You can use a pay stub instead. But having the actual documents will make the results more accurate.

Be tax ready all year long with these free tax calculators

-

TaxCaster Tax

CalculatorEstimate your tax refund and see where you stand

I’m a TurboTax customer

I’m a new user -

-

W-4 Withholding Calculator

Know how much to withhold from your

paycheck to get

a bigger refund

Get started -

Self-Employed

Tax CalculatorEstimate your self-employment tax and

eliminate

any surprises

Get started -

-

Self-Employed Tax

Deductions CalculatorFind deductions as a 1099 contractor, freelancer, creator, or if you have a side gig

Get started -

Estimate your refund anytime,

on the go

Download the TaxCaster Tax Calculator App to your Android

or iPhone. We save your information — change it anytime and

our tax calculator will show you how it affects your federal

tax refund.

Learn more about what's new for your tax refund

8 Common Life Events That Affect Your Taxes

See how life events like getting married, going back to school, or having a child can change your tax refund.

Read more

12 Smart Things to Do With Your Tax Refund

Anticipating a tax refund after using our tax refund estimator? Set yourself up for the future by making smart

money decisions.

Read more

What Is Adjusted Gross Income (AGI)?

When you file your taxes, your adjusted gross income (AGI) can impact your eligibility for deductions and credits that can boost your tax refund.

Read more

What Are Tax Credits?

Tax credits can reduce how much income tax you owe, and can add to your tax refund. However, tax credits come with requirements you must satisfy before claiming them.

Read more

Why Is My Refund Not What I Expected?

Learn more about the changes to tax benefits and adjustments that may have impacted your original estimate for your tax refund.

Read more

What Information Is Needed for Tax Returns?

Learn more about the changes to tax benefits and adjustments that may have impacted your original estimate for your tax refund.

Read more

What Is My Federal Tax Rate?

Review the federal tax rate schedules and tax bracket calculator to help you estimate your refund.

Read more

What Is a W-4?

The W-4 determines how much is withheld from your paycheck. Use this guide to make sure you're filling it out correctly.

Read more

How to Lower Your Effective Tax Rate

These tips can help you lower your effective tax rate and your tax bill.

Read more

See how our customers rate TurboTax

When Will I Get My Tax Refund?

Learn how to check your refund status and track your refund so you know when to expect it.