What is Form 8903: Domestic Production Activities Deduction

The Domestic Production Activities Deduction provides tax incentives for businesses that produce goods or work primarily in the United States. This applies to everything from film production to construction. Learn more about the Domestic Production Activities Deduction and how it's been impacted by the introduction of the Qualified Business Income (QBI) deduction.

The One Big Beautiful Bill that passed includes permanently extending tax cuts from the Tax Cuts and Jobs Act, including increasing the cap on the amount of state and local or sales tax and property tax (SALT) that you can deduct, makes cuts to energy credits passed under the Inflation Reduction Act, makes changes to taxes on tips and overtime for certain workers, reforms Medicaid, increases the Debt ceiling, and reforms Pell Grants and student loans. Updates to this article are in process. Check our One Big Beautiful Bill article for more information.

The Domestic Production Activities Deduction ended in 2017 when the Qualified Business Income Deduction (QBI Deduction) was introduced.

Key Takeaways

- Form 8903 is used to claim the Domestic Production Activities Deduction, giving tax incentives for producing goods or performing work in the U.S.

- This deduction was available from 2005 to 2017 and applied to a wide range of activities like construction, film production, and architectural services for domestic projects.

- You could deduct up to 9% of the income from qualifying activities, but there were limitations like only being able to deduct up to half of the wages paid to employees involved in domestic production.

- The deduction couldn't exceed your corporation's taxable income, ensuring it was beneficial but not overly generous.

Purpose and nature of the tax deduction

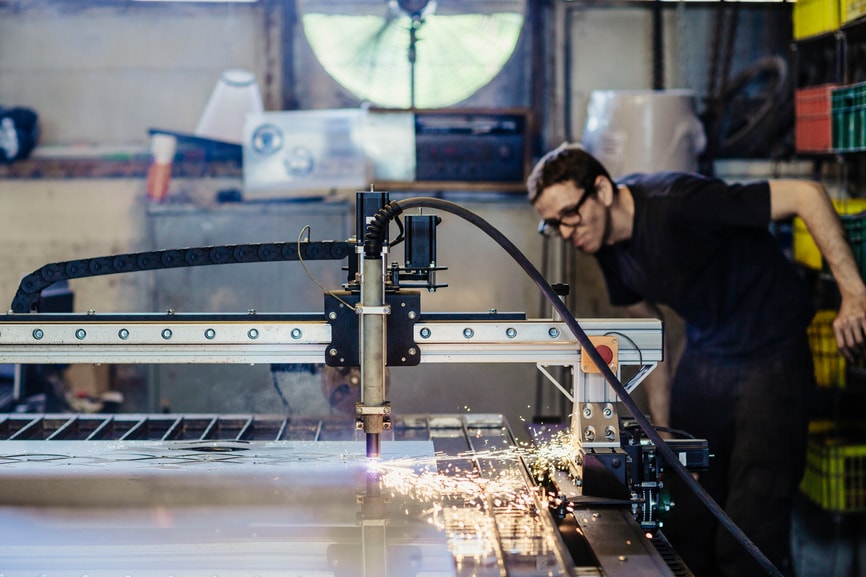

The Domestic Production Activities Tax Deduction is intended to provide tax relief for businesses that produce goods in the United States rather than producing it overseas. The deduction was in effect for tax years 2005 through 2017 and applied to both small and large businesses.

The tax deduction is often associated with oil-related businesses: the form itself has two columns, one of which is devoted to "oil-related activities." However, the deduction can apply to almost any business that manufactures, grows, extracts, produces, develops, or improves goods primarily in the United States.

Qualifying domestic production activities

The term "domestic production activity" cuts across a broad swath of businesses. The IRS has determined that businesses qualifying for the deduction must undertake work in one of the following categories:

- Construction performed in the United States

- Electricity, potable water, or natural gas produced in the United States

- Films and videos produced at least 50% in the United States

- Architectural or engineering services performed in the United States for domestic construction projects

- The disposition of tangible personal property, sound recordings, or computer software created or developed, in whole or in part, in the United States

Certain exceptions apply. For example, rental income doesn't qualify under the construction category, and sexually explicit films don't qualify under the film production deduction. However, "tangible personal property" is an extremely broad category, and many businesses, from magazines and newspapers to home-based craft stores may qualify for the deduction.

TurboTax Tip:

The Domestic Production Activities Deduction ended in 2017 with the introduction of the Qualified Business Income Deduction.

Tax deduction amounts and limitations

The maximum credit you can claim under the domestic production activities tax deduction is 9% of the income you earn from the business. Since the intent of the deduction is to increase production and employment in the United States, your business can only qualify if it has employees.

Additionally, the deduction carries two significant limitations:

- You can only deduct up to half the amount you pay to your workers engaged in domestic production.

- Your deduction can't exceed your corporation's taxable income.

If you operate a Sole proprietorship, S corporation, partnership, or LLC, the deduction is limited to your adjusted gross income.

Using Form 8903

Form 8903 is a 25-line, one-page form on which you can calculate your allowable domestic production deduction. Essentially, you'll enter the cost of production and the income you generate from those activities.

After calculating all of the applicable limitations to your deduction, on line 25 you'll arrive at your allowable domestic production activities tax deduction. For most taxpayers, that amount will transfer to either line 35 of Form 1040 for individuals or line 25 of Form 1120 for corporations.

With TurboTax Experts for Business, get unlimited expert help while you do your taxes, or let a tax expert file completely for you, start to finish. Our small business tax experts are matched to your specific industry and stay up to date on the latest tax laws, ensuring you get every credit and deduction possible to keep more money in your business. Small business owners get access to unlimited, year-round advice and answers at no extra cost and a 100% accurate, Expert Approved guarantee.