Maximizing Tax Deductions for the Business Use of Your Car

The business use of your car can be one of the largest tax deduction you can take to reduce your business income. This is a big, big deal. Why two “bigs”? Because your business income is used to calculate two taxes: your personal income tax and your self-employment tax (the amount you pay into Social Security and Medicare as the “owner” of your rideshare business). Maximizing your deduction for the business use of your car will help you minimize these taxes.

Key Takeaways

- Deducting the business use of your car can reduce both your personal income tax and your self-employment tax (the amount you pay into Social Security and Medicare as the “owner” of your rideshare business).

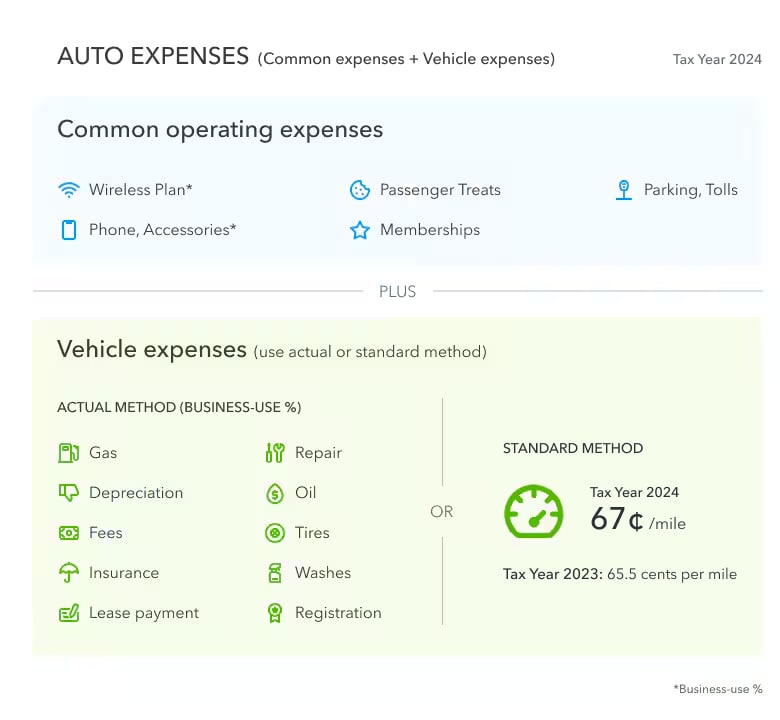

- One method of calculating the business use of your car is to total your actual expenses—gas, oil, insurance, vehicle depreciation, etc.—and multiply that amount by the percentage of miles you drove for your business (not personal use).

- Instead of actual expenses, you can use the per-mile Standard Mileage rate set by the IRS. The rate is 67 cents per mile for 2024.

- If you want to use the standard mileage rate, you must choose it in the first year you use the car for business. In later years you can choose to use the standard mileage rate or switch to actual expenses.

Two methods

There are two methods of calculating the business use of your car. You’ll want to calculate your vehicle expenses each way and then choose the method that yields the largest deduction for you. If you are using TurboTax Premium, check out How do I enter my Lyft tax information? for step-by-step instructions.

The Actual Expenses method

The Actual Expenses method is based on the expenses you actually incur in the operation of your vehicle. It includes things like:

- gas purchases

- oil changes

- tire purchases

- car washes

- insurance

- and even vehicle depreciation

However, you can only claim the percentage of expenses that apply to the business use of your vehicle. To compute this, you must know how many miles you drove for business purposes and how much you drove for personal reasons. Lyft provides this important information on your Driver Dashboard as well as on your year-end Annual Summary sheet. You can find it under the heading Online Miles. Add these miles to any other business miles to get your total business miles.

To find the percentage of your car’s use for business, divide your total business miles by the total number of miles you drove for the year (business + personal).

- For example, if your Annual Summary show that you drove 5,000 online miles and your odometer indicates you drove 10,000 miles for the year, divide 5,000 by 10,000.

- The result is 0.5, or 50%. This is the percentage of your vehicle’s business use.

You then multiply the total of your actual expenses by this percentage to arrive at your actual expenses deduction.

- For example, if your actual expenses were $9,500, you would multiply that figure by 50 percent.

- Your deduction would be $4,750 ($9,500 x .50 = $4,750).

The deduction is large, because the actual expenses are large. In the example above, the actual expenses include:

- $1,000 gas

- $1,500 insurance

- $6,000 lease payments

- $400 repairs

- $100 oil

- $500 car washes

TurboTax Tip:

Lyft provides the number of miles you drove for business purposes on your Driver Dashboard as well as on your year-end Annual Summary sheet. You can find it under the heading Online Miles. Add these miles to any other business miles to get your total business miles.

Standard Mileage method

The second method you can use to compute the business use of your car is called Standard Mileage. You should still track both your personal and business miles but you will only use the business portion to calculate your deduction. As mentioned above, Lyft does this for you on the Lyft Driver Dashboard and on the Annual Summary sheet. Your miles are shown under Online Miles. In the example above, the driver logged 5,000 online miles. Add these miles to any additional business miles to get your total business miles.

To compute the deduction for business use of your car using Standard Mileage method, simply multiply your business miles by the amount per mile allotted by the IRS.

- In the example above the deduction turns out to be $3,350 (5,000 miles x $.67 = $3,350). The rate for 2024 is 67 cents per mile.

In theory, both methods of calculating the expense of business use of your car should produce roughly the same result. In the example above, however, the driver’s large lease payments and low mileage result in a higher deduction using Actual Expenses than using Standard Mileage—$4,750 compared to $2,925. You are entitled to the larger deduction.

If a driver’s mileage were higher, the Standard Mileage deduction might yield a larger deduction, like in the example below.

A Lyft driver has logged 40,000 miles in 2024, and 30,000 of those miles are for business. When you divide 30,000 by 40,000, the result is 0.75, or 75%. This was the percentage of this driver’s vehicle business use. The driver not only drove more miles, but also had larger actual expenses:

- $4,000 gas

- $3,160 depreciation

- $1,500 insurance

- $1,200 repairs

- $190 oil

- $500 tires

- $750 car washes

This driver’s Actual Expenses total $11,300 and since this driver used the car 75% of the time for business, the Actual Expenses deduction is $8,475 ($11,300 x .75 = $8,475). That’s a lot.

However, when you multiply the driver’s 30,000 miles by the IRS’s 2024 mileage rate of 67 cents per mile, the result is a whopping $20,100 (30,000 x .67 = $20,100). In this example, the driver is able to deduct $11,675 more by using the Standard Mileage method than by using the Actual Expenses method ($20,100 compared to $8,475).

As these examples demonstrate, the two methods can yield vastly different results. Be sure to keep all your receipts so you can calculate the deduction both ways and then choose the method that benefits you the most.

Also, if you want to us the standard mileage rate, you must choose it in the first year you use the car for business. In later years you can choose to use the standard mileage rate or switch to actual expenses.

Just a reminder

As important as your vehicle expenses are for reducing your tax bill, they are not your only business deductions. The form you’ll use to calculate your net business income, Schedule C, Profit or Loss From Business, has lines for several types of business expenses.

Common expenses for a ridesharing business include:

- a phone

- a wireless plan

- passenger refreshments

- parking fees

- and tolls

The chart below shows the typical business expenses for a Lyft driver.

As with mileage, you can only deduct the expenses related to your business. If you use an item in both your personal life and your business, you must calculate the percentage of use for each.

- For example, if you use the same wireless plan for both your personal phone use and your business phone use, you must calculate how much of your use applies to your business.

- You can deduct only that portion of your bill from your business income.

To make it easier to track their expenses, some Lyft drivers purchase a phone for business use only. That way they can deduct 100% of the expenses associated with that phone and not worry about calculating percentages of use. But be sure to save all bills, receipts, and other documentation related to your business expenses. The IRS can disallow any deductions that aren’t fully documented.

With TurboTax Live Business, get unlimited expert help while you do your taxes, or let a tax expert file completely for you, start to finish. Our small business tax experts are always up to date with the latest tax laws and will ensure you get every credit and deduction possible, so you can put more money back into your business. Small business owners get access to unlimited, year-round advice and answers at no extra cost and a 100% Accurate, Expert Approved guarantee.