Video: What Are Tax Deductions?

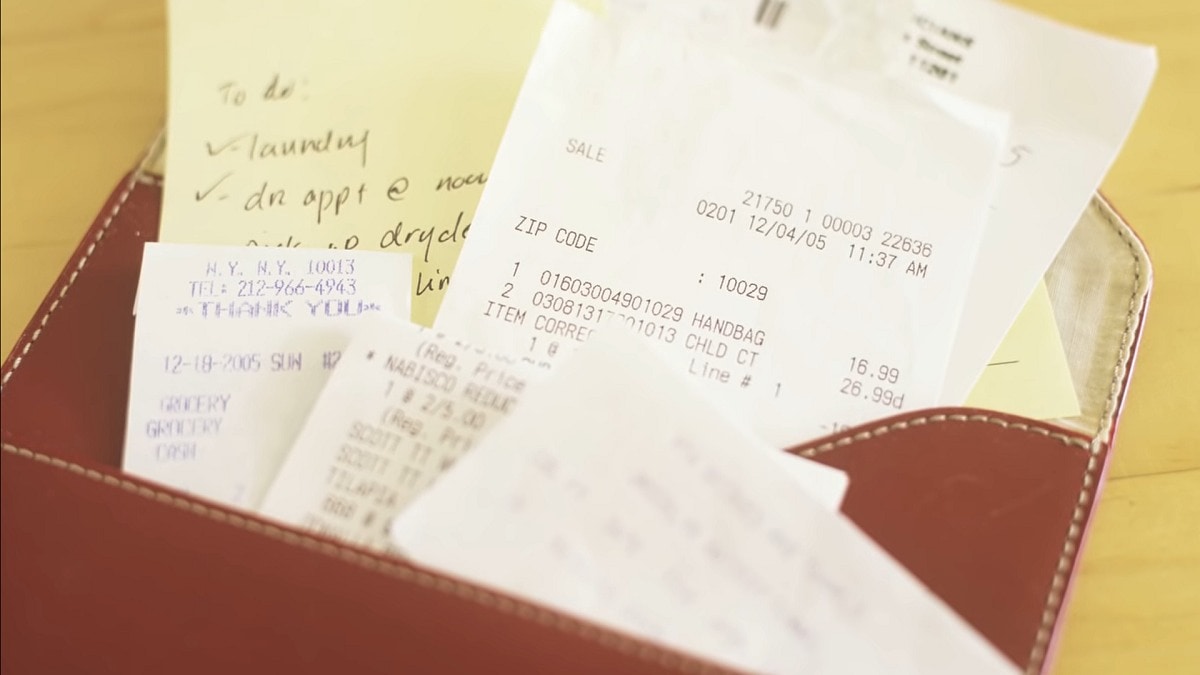

Tax deductions reduce the amount of tax you owe by allowing you to subtract certain expenses from your income.

The article below is accurate for tax years prior to 2018. Beginning in 2018, some of the deductions referenced below are no longer available.

Video transcript:

Hi, I'm Jeremy from TurboTax, with important news for taxpayers.

Tax deductions reduce the amount of tax you owe by allowing you to subtract certain expenses from your income. By effectively lowering your taxable income, deductions reduce the amount of tax you owe.

Typically, you must itemize your deductions to receive the full benefit. The alternative is to take the standard deduction offered by the IRS. If your total deductible expenses for the year are more than the standard deduction amount then you will save more by itemizing.

There are certain types of deductions you can take regardless of whether you are eligible to itemize or not. These expenses are reported separately from standard and itemized deductions. They include college tuition payments for yourself and other dependents, alimony payments to a former spouse and even your moving expenses if you relocate for a new job. For those of you who can itemize deductions, there are many expenses you an include that are not available to those who claim a standard deduction.

When it's time for you to prepare your tax return, keep in mind that the government allows you to deduct some common expenses such as mortgage interests and property taxes for your home, donations made to charity and medical and dental expenses.

There are others that are not quite as common and often overlooked like the cost of looking for work or traveling to an interview when non-employed. The more expenses you have that are eligible for deduction, the smaller your tax bill will be and if you have amounts withheld from your check for income taxes, they can increase the amount of your refund check.

With TurboTax Live Full Service, a local expert matched to your unique situation will do your taxes for you start to finish. Or, get unlimited help and advice from tax experts while you do your taxes with TurboTax Live Assisted.

And if you want to file your own taxes, you can still feel confident you'll do them right with TurboTax as we guide you step by step. No matter which way you file, we guarantee 100% accuracy and your maximum refund.