Live Assisted Self-Employed is now Live Assisted Premium

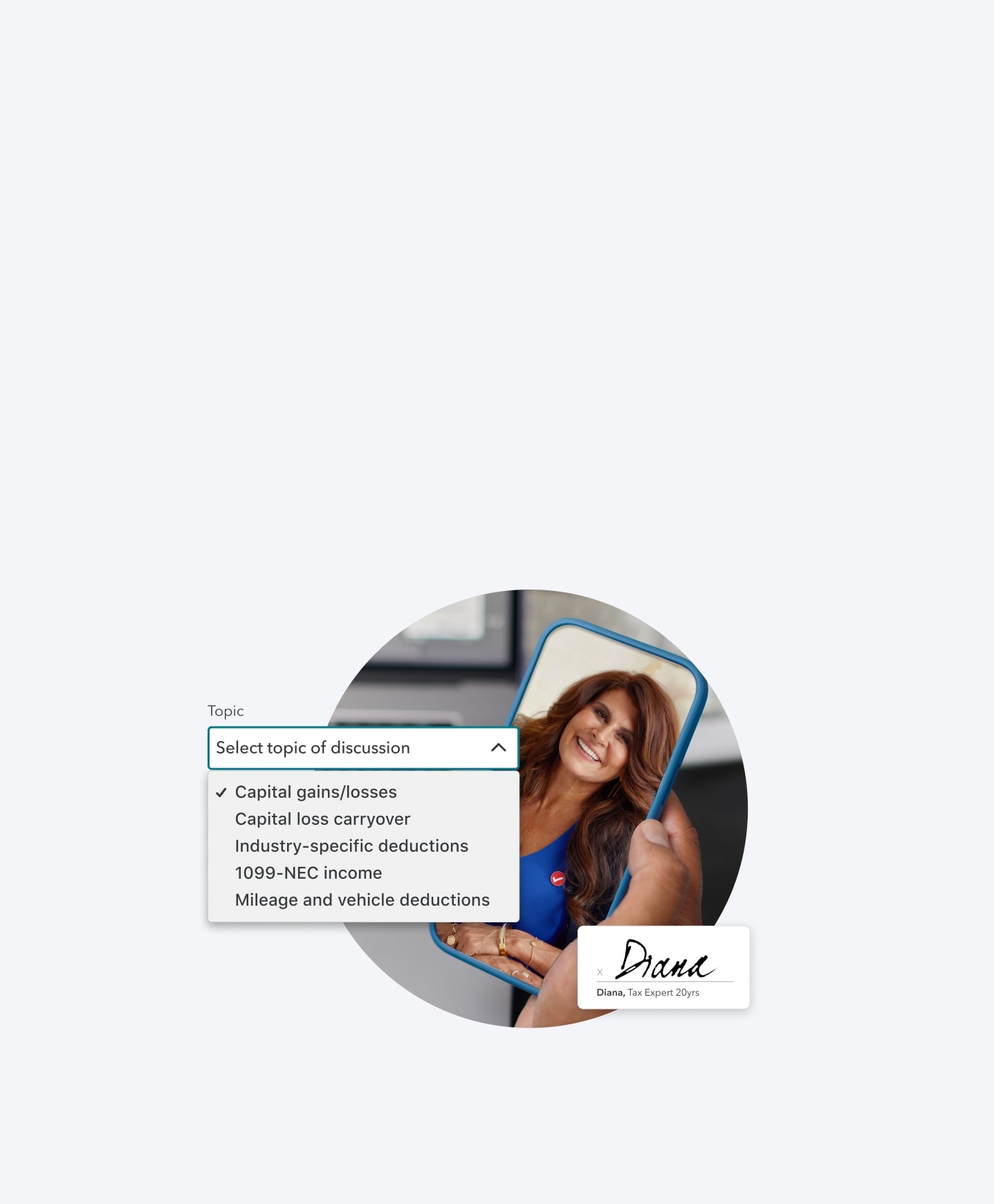

Get unlimited expert advice and uncover every tax deduction for your investment and self-employment income.

Get expert help with TurboTax Live Assisted Self‑Employed

Our specialized experts offer unlimited help for freelancers, independent contractors,

and gig workers.

File with confidence and get every dollar you deserve, guaranteed.

Ayuda disponible en español

Make sure you don’t miss self-employment deductions

Sync your financial accounts and we’ll find and categorize your work-related deductions1.

*Actual customer testimonials. Photos are illustrative only.

TurboTax Live Assisted

Self-Employed features

-

Automatically import and categorize deductions

No need to find your receipts—we’ll help you identify and uncover business deductions. (Limited availability1)

-

Find industry-specific deductions

Get expert help maximizing unique deductions across diverse industries: real estate, courier & delivery driving, specialty-trade construction, online selling & retail, professional consulting, beauty professions and many more.

-

Ideal for

1099-NEC incomeWe’re designed for independent contractors, freelancers, and business owners. Note: Self-employed income is now reported on the 1099-NEC form, not 1099-MISC.

-

Snap & auto-fill your 1099-NEC or 1099-K

Easily and conveniently upload your 1099-NEC or 1099-K with just a snap from your smartphone.

-

Get a personalized audit assessment

We’ll help you file your self-employment taxes by calling out potential red flags and uncovering deductions you may have missed.

-

Mileage and

vehicle deductionsLet us determine if actual expenses or the standard mileage rate will get you the biggest

tax deduction. -

Easy import from QuickBooks

Self-EmployedWe'll automatically import your QuickBooks Self-Employed income and expense accounts and classify them for you.

-

Extra guidance for freelancers and gig workers

Have an expert show you deductions so you can keep more of your hard-earned money.

-

Simplify asset depreciation

Maximize your deductions with expert guidance, including assets like rental properties.

-

Every self-employed

tax deductionWe’ll search 500 tax deductions to ensure you don’t miss a thing. Business travel, entertainment, office supplies, operating costs, and many more are all covered.

-

Employee stock plan support

Bought or sold employee stock? Easily determine your correct basis for stocks purchased and more.

-

Accurate investment tax reporting

Report sales of stocks, crypto, bonds, and mutual funds, plus calculate capital gains/losses with guidance from an expert.

-

Community help

Get unlimited access to the helpful TurboTax community if you have questions about doing your taxes.

-

Don’t want to do your own taxes?

Choose TurboTax Live Full Service Premium and let a tax expert do taxes for you, start to finish. Get matched with an expert who understands your unique situation, provides insight and advice, and gets you the best outcome.

![]()

Windows

-

Windows 10.x

- Firefox 68.x

- Edge 17

- Chrome 74.x

- Opera 64.x

-

Windows 8.1

- Firefox 68.x

- Edge 17

- Chrome 74.x

- Opera 64.x

-

Mac OS 11.0

(Big Sur)- Safari 14.x

- Chrome 83.x

- Firefox 77.x

- Edge

- Opera 64.x

-

Mac OS X 10.15.x (Catalina)

- Safari 13.x

- Chrome 77.x

- Firefox 70.x

- Edge

- Opera 64.x

-

Mac OS X 10.14.x (Mojave)

- Safari 13.x

- Chrome 74.x

- Firefox 68.x

- Edge

- Opera 64.x

-

iOS 12.x

- Safari

- Chrome

- Firefox

-

Android 7.x

- Chromium default browser

-

Chromebook

- Chrome

Your tax refund, your way

Get your refund as a check, direct deposit, or up to 5 days early* on a Credit Karma Money™ checking or savings account. *Terms apply.

Full Service I Business

NEW! Hand off your

business taxes

For partnerships, S-corps, and multi-member LLCs,

Full Service Business has you covered.

Frequently asked questions

You don't need anything but your email address to get started with TurboTax. Just answer a few simple questions and you're on your way.

You don't even need to have your W–2s or 1099s—we can import that information directly from more than a million participating employers and

financial institutions.

Learn more about importing into TurboTax.

For more complex tax situations you may need additional documents, like mortgage statements or other detailed financial information. But since we save your return as you go, you can finish anytime.

With TurboTax Live Assisted, you can file confidently with experts by your side.

No matter how complex your tax situation, you can get advice from tax experts who can help you finish your taxes error-free, review your return at the end, and guarantee you’ll get every dollar you deserve.

Yes. We offer free one-on-one audit guidance year-round from our experienced and knowledgeable tax experts. We'll let you know what to expect and how to prepare in the unlikely event you receive an audit letter from the IRS.

If you've already received a letter from the IRS for a return you filed with TurboTax, please review our Audit Support Guarantee for instructions on how to receive FREE step–by–step audit guidance and the option to connect with an expert.

We also offer full audit representation for an additional fee with MAX Defend

& Restore.

Get your maximum tax

refund — guaranteed

-

We search hundreds of tax deductions

We’ll find every tax deduction and credit you qualify for to boost your tax refund.

-

100% Accurate Expert

Approved GuaranteeIf you pay an IRS or state penalty (or interest) because of an error that a TurboTax expert made while providing topic-specific tax advice, a section review, or acting as a signed preparer for your return, we'll pay you the penalty and interest.

-

100% accurate calculations

Our calculations are 100% accurate on your tax return, or we’ll pay any IRS penalties.