SECURITY

Security is built into everything

we do

TurboTax works hard to safeguard your information so you can

file worry-free.

Safeguards every time you sign in

Multi-factor authentication

You can securely access your account by entering your password and a unique, single-use code we'll send to your verified device or email address, authentication application; or answer a series of questions.

BioMetric support

Your unique fingerprint or facial recognition capability is supported on capable devices to access your account via the TurboTax app

Protecting your personal info

Data encryption

We encrypt any of your data that we store, and when we electronically send your return to the IRS or state agencies, we use industry standard TLS encryption.

Stay informed

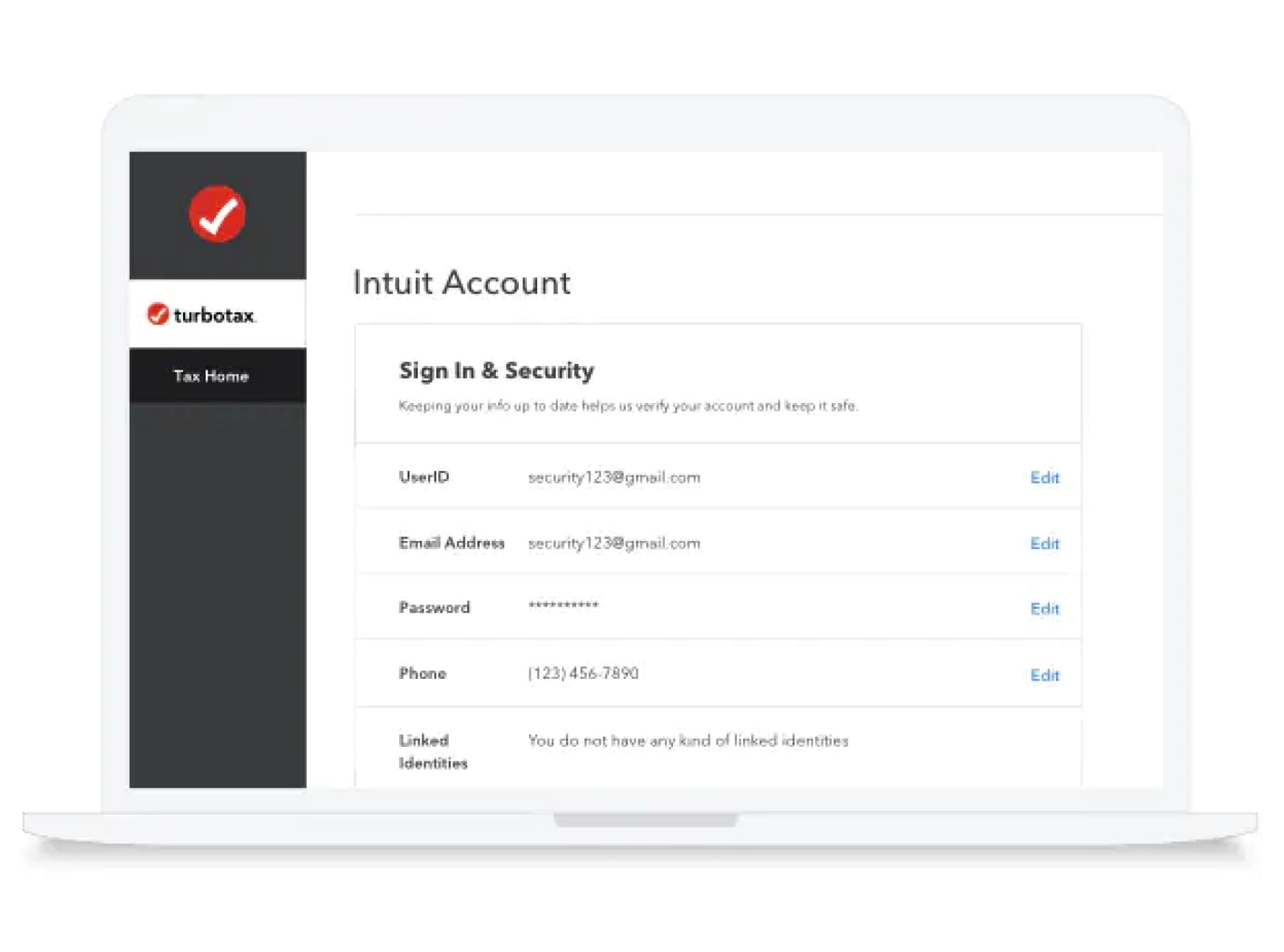

Login and device activity

Easily see the login history and devices used to access your account so you can spot unusual activity.

Auto email notifications

We’ll notify you of changes made to your account,

such as updating your payment method, changing

your password, or signing in for the first time on a

new device.

File with confidence

-

Dedicated security staff

TurboTax security specialists work to protect your personal information through monitoring, internal checks, and external tests. As an industry leader,

we continually work with the

IRS and state revenue departments on

anti-fraud measures. Together,

we’re raising the bar for detecting

suspicious behavior.

If you believe your account has been compromised or have any security-related questions,

contact us today. -

How can you protect your information

Keeping your information safe is a shared responsibility. Never give anyone your user ID and password, always use unique, hard–to–guess passwords, and be vigilant.

Additional ResourcesCreate strong passwords and choose a good user ID

Use safety measures and good practices to protect

your computer

How to spot and avoid phishing, pharming, vishing

and smishing

Tax tips if your identity has been stolen

Keeping yourself safe from tax

scams today

For more, visit our Online Security Center.